FinTech for SMEs: How Digital Platforms Are Bridging the Gap in ASEAN

FinTech for SMEs: How Digital Platforms Are Bridging the Gap in ASEAN

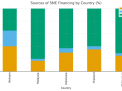

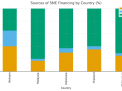

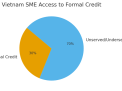

SMEs comprise over 90% of all businesses in the region and contribute heavily to GDP and jobs. In Vietnam alone, SMEs and private business households produce roughly half of GDP and 82% of employment. Despite their importance, most SMEs struggle to access affordable credit. Traditional banks often consider small firms high-risk due to insufficient collateral, limited financial records, or informal operations. As a result, an estimated 98% of Vietnamese SMEs have difficulty securing bank loans or face exorbitant interest rates. The situation is similar across emerging ASEAN markets – roughly 39 million SMEs (51% of the total in Southeast Asia) are unserved or underserved by financing, contributing to a massive $272 billion SME funding gap in Southeast Asia. These businesses typically need smaller, short-term loans and quick credit decisions, which traditional lenders are ill-equipped to provide. The financing shortfall has real economic costs, constraining business expansion and innovation.

Digital Platforms Bridging the Gap for Small Businesses

Across ASEAN, a wave of digital platforms – from lending fintechs to neobanks and crypto services – are bridging the gap for underserved SMEs. These platforms bring alternative financing, easier banking, and new financial tools directly to small businesses:

- Peer-to-Peer and Alternative Lending: Online lending marketplaces have scaled up to connect SMEs with capital outside traditional banks. In Indonesia, for instance, P2P lender Akseleran has disbursed nearly IDR 6.6 trillion (over $400 million) in loans to small businesses by 2022. Such platforms allow groups of investors or institutions to fund SME loans at competitive rates, often using flexible terms and innovative credit scoring. Malaysia’s CapBay platform similarly uses data analytics to provide supply chain financing and has facilitated over MYR 3 billion (~$640M USD) to more than 1,700 underserved SMEs. By leveraging machine learning and alternative data, these fintech lenders can offer smaller, short-term loans and invoice financing that banks have historically avoided. The result is faster access to working capital for inventory, cash flow, or expansion needs – without the onerous collateral requirements of banks.

- Neobanks and Digital Banking Services: A new breed of digital-only banks is emerging to serve entrepreneurs and small enterprises with convenient, low-cost banking. In Singapore, regulators awarded digital banking licenses aimed at enhancing inclusion – Ant Group’s ANEXT Bank launched in 2022 as a wholesale digital bank focusing on micro and SMEs, offering quick online business accounts and lending solutions. Regional fintech startups like Aspire have built all-in-one finance platforms for SMEs, providing everything from multi-currency business accounts to expense management and payable/receivable tools. Headquartered in Singapore, Aspire now helps over 15,000 companies across Asia manage payments and cash flow digitally, and saw its annualized transaction volumes triple to $12 billion in 2023. These digital-native services save SMEs time and money, with features like instant account opening, integration with accounting software, and data-driven credit lines without heavy paperwork. The ASEAN region is also seeing incumbents partner with fintechs – for example, Thailand’s KBank and Indonesia’s BTPN have launched app-based SME banking services – blurring the line between traditional and challenger banks in the SME segment.

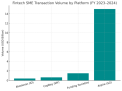

- Embedded Finance in Platforms: Some of the biggest impacts have come from fintech embedded in e-commerce, payments, and super-app ecosystems that SMEs already use. Southeast Asia’s super-apps (like Grab and GoTo) and online marketplaces now provide financial services to the small businesses on their platforms. Grab Financial Group’s “Grow with Grab” initiative is one example – Grab offers working capital loans and micro-insurance to its network of drivers, delivery partners, and merchant sellers seamlessly through its app. In fact, Grab’s data-driven micro-lending products for small businesses and gig workers have addressed a critical gap in the credit market, disbursing $420 million in loans in just Q2 2025 and maintaining a low 1.8% non-performing loan ratio. By analyzing ride-hailing and sales data, Grab can extend credit to entrepreneurs who banks would deem “un-creditworthy,” all within a user-friendly mobile interface. Similarly, e-commerce platforms are enabling sellers to get financing based on their online sales history, and fintech partners like Funding Societies (Modalku) have teamed up with marketplaces to lend to merchants. This embedded finance approach folds banking into the software SMEs use daily, making access to capital almost invisible and exceedingly convenient.

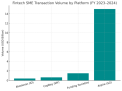

- Digital Payments and Cross-Border Tools: Fintech innovation has also made it easier for small businesses to pay and transact globally – a domain once dominated by banks. Cross-border payment fintechs such as Airwallex and Wise provide SME-friendly platforms to send and receive international payments with lower fees and better FX rates, helping businesses integrate into global supply chains. Meanwhile, digital wallets and QR payments have proliferated in domestic markets (e.g. Vietnam’s MoMo, Malaysia’s Boost), enabling even micro-entrepreneurs and street vendors to accept cashless payments and build a transaction history. This digital footprint can later support credit assessments. Cryptocurrency platforms and blockchain innovations are starting to play a role as well. For instance, some SMEs are beginning to use stablecoins (crypto tokens pegged to fiat currency) to handle cross-border remittances and supplier payments, avoiding high bank transfer costs. Regulators in ASEAN are cautiously opening doors to such innovation – in 2025, the Vietnamese government introduced its first licensing regime for cryptocurrency exchanges, launching a five-year pilot to integrate digital asset trading into the formal financial system. By recognizing and regulating digital assets, Vietnam aims to enable blockchain-powered financial services under proper oversight, which could eventually benefit SMEs through new funding and payment options. Fintech companies that bridge traditional finance and crypto – offering, say, invoice loans alongside stablecoin remittance services – may give SMEs a more borderless financial toolkit.

ASEAN Case Studies: Fintech Impact on SMEs

The fintech-for-SME trend is evident in success stories across Southeast Asia’s diverse markets. A few examples illustrate how digital platforms are empowering small businesses in the region:

- Indonesia: Home to a booming fintech lending industry, Indonesia has leveraged regulation (through the Financial Services Authority, OJK) to foster responsible P2P lending growth. Platforms like Akseleran connect thousands of Indonesian SMEs with retail and institutional lenders, providing flexible loan terms and even accepting non-traditional collateral. By 2022 Akseleran had served more than 200,000 individual lenders and disbursed over IDR 6.6 trillion (about $407 million) in loans, an 80% revenue increase from the prior year. Other Indonesian fintech leaders include KoinWorks and Modalku (Funding Societies), which together have funneled billions of rupiah into the small business sector that banks historically ignored. The government reports that fintech lenders have reached many first-time SME borrowers, though ensuring prudent risk management remains a priority. The Indonesian case shows how a large financing gap can be narrowed when tech and regulatory support align.

- Malaysia: In Malaysia, fintech innovation in supply chain and invoice financing is helping SMEs maintain cash flow. CapBay, an award-winning Malaysian fintech, partners with banks and uses a proprietary credit-decisioning model to evaluate SMEs based on trade data and relationships, not just balance sheets. This approach has enabled CapBay to channel over MYR 3 billion (≈$643 million) to more than 1,700 SMEs across 20 industries, even offering micro-sized financing deals as low as MYR 100 (≈$21) to include the smallest enterprises. By tapping analytics and machine learning to assess risk, CapBay and peers have expanded financing to businesses that would otherwise be too costly for banks to underwrite. Malaysia has also embraced digital banking – in 2022, Bank Negara Malaysia awarded several digital bank licenses aimed at underserved segments, prompting traditional banks to up their digital game for SME customers.

- Singapore: As a regional fintech hub, Singapore has encouraged both incumbents and startups to deliver SME-centric financial services. Aspire (Singapore) exemplifies the new generation of SME neobanks. Founded in 2018, Aspire offers a one-stop financial platform with business accounts, corporate cards, expense tracking, and automated invoice management, all through a single app. Its user base has spread beyond Singapore to other ASEAN markets, and by 2023 Aspire was handling $12 billion in annualized payment volumes for its clients while attracting major investors like Sequoia and Y-Combinator. At the same time, Singapore’s traditional banks are innovating: DBS, for example, launched a quick online SME account opening service and AI-driven lending. The Monetary Authority of Singapore’s introduction of digital bank licenses pushed big tech players into the fray as well – ANEXT Bank (by Ant Group) and Green Link Digital Bank both debuted in 2022 to serve SMEs and cross-border commerce, leveraging their parent companies’ fintech expertise. These developments underscore a broader trend: banks and fintechs in Singapore are collaborating and competing to make SME banking more accessible, digital, and data-driven, from instant loan approvals to integrated accounting solutions.

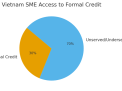

- Vietnam: Vietnam represents a significant “hilltop” opportunity for fintech to transform SME finance, given its fast-growing economy and large population of underserved businesses. The country has around 800,000 enterprises and 5 million sole proprietorships fueling its economy, yet conventional bank lending reaches only a sliver of them. Nearly 70–80% of Vietnamese SMEs cannot access bank loans due to lack of collateral or credit history. In practice, many resort to informal “black credit” sources at high interest, or limit their growth ambitions. Recognizing this, Vietnam’s government and central bank (SBV) have prioritized digital banking and fintech solutions as key to improving SME access to finance. Vietnam is also witnessing rapid adoption of e-wallets (e.g. MoMo, ZaloPay) among merchants and consumers, creating a more digital-friendly financial ecosystem. With supportive moves like the government’s sandbox for crypto exchanges and efforts to bolster credit guarantee funds, Vietnam is laying groundwork for fintech to flourish. The stage is set for innovative platforms to fill the massive credit gap and help Vietnamese SMEs – who currently contribute ~41% of GDP – reach their full potential.

- Regional Super-App Finance: Large tech platforms across ASEAN have turbocharged financial inclusion for micro-entrepreneurs. We’ve touched on Grab’s fintech expansion; similarly, Indonesia’s GoTo Group (formed from Gojek and Tokopedia) provides fintech services to drivers and small retailers, and Philippines’ Mynt (GCash) offers mobile credit to small shop owners based on wallet transactions. Even as standalone fintechs thrive, these ecosystem approaches show how integrating finance into everyday digital services can rapidly scale outreach. The common thread is data – by leveraging transaction data, ride logs, or sales history, these platforms can underwrite credit and insurance for users who lack traditional financial records. And thanks to their consumer reach, they can educate and upsell users on financial products in a familiar context. This has been critical in ASEAN markets where trust in banks is low but smartphone use is high. Regulators have largely welcomed these developments, issuing digital bank licenses to consortia involving tech firms (as seen in Malaysia, Indonesia, Singapore) and updating fintech regulations to ensure consumer protection while encouraging innovation.

Regulatory Trends Supporting FinTech Innovation

One reason fintech platforms are booming in ASEAN is a gradually more supportive regulatory environment. Policymakers have recognized that traditional financial rules need updates to accommodate new digital models that benefit SMEs. Key regulatory insights and trends include:

- Digital Banking Frameworks: Several ASEAN countries have created new licensing categories for digital banks, many with a mandate to promote financial inclusion. Singapore led the way by granting digital full bank and wholesale bank licenses in 2020; winners like Grab-Singtel (GXS Bank) and Ant Group (ANEXT) explicitly focus on underserved consumers and small businesses. Malaysia followed in 2022, awarding five digital bank licenses aimed at innovative models to reach the unbanked and micro-SMEs. These frameworks typically require robust capitalization and compliance, but allow non-bank players to offer banking services without a brick-and-mortar presence. Indonesia updated its rules to accommodate digital banking by both incumbents and new entrants (for example, Bank Jago’s digital transformation). And while Vietnam has not issued a separate digital bank license yet, it enabled partnerships like PVcomBank–Vemanti to operate under existing bank charters, effectively achieving digital bank functionality. Regulators are striking a balance between innovation and stability – ensuring new digital banks have proper risk controls while pushing incumbent banks to digitize and SME-proof their offerings.

- Fintech Sandboxes and Pilots: To safely experiment with new financial technologies, regulators across ASEAN have introduced sandboxes and pilot programs. For instance, Bank Indonesia and the OJK have sandbox programs for P2P lending, digital payments, and most recently fintech credit scoring, which helped craft regulations that legitimize P2P lending as a significant industry. Thailand and Philippines have similar sandboxes allowing fintechs to test products under supervision before mass rollout. A notable development is Vietnam’s aforementioned crypto asset pilot program – in 2025 the government launched a 5-year sandbox for regulated digital asset exchanges. Under Resolution No. 05/2025/NQ-CP, Vietnam will license a limited number of crypto exchange operators who meet strict capital and compliance requirements, bringing what was a grey-market activity into an official framework. This not only protects investors but also paves the way for innovations like stablecoins for cross-border payments, which could greatly benefit SMEs engaged in international trade. The sandbox approach in ASEAN has proven useful in gathering data and adjusting policies – as seen with Malaysia’s early P2P/EDI (equity crowdfunding) sandbox leading to formal guidelines that now oversee dozens of alternative finance platforms.

- Open Banking and Data-Sharing Regulations: Some ASEAN regulators are implementing or exploring open banking rules, which require banks to share customer data securely with third-party fintech apps (with consent). Singapore’s API Exchange (APIX) and Malaysia’s Open Data initiatives are steps in this direction. By liberating customer financial data (transaction history, etc.), open banking can enable fintech lenders to better evaluate SME borrowers and offer customized products. It also spurs the development of fintech solutions that aggregate accounts, help with cash flow forecasting, etc., giving SMEs a more holistic financial view. While still in nascent stages in ASEAN compared to Europe’s PSD2 regime, the momentum is growing. Indonesia’s regulators have signaled moves toward open finance frameworks, and Vietnam has mentioned digital banking as part of its Strategy for Banking Digital Transformation by 2025. As these policies mature, they will further level the playing field for fintechs and encourage banks to partner via APIs, ultimately benefiting SMEs with more choice and competition.

- Credit Infrastructure and Guarantees: Government initiatives to bolster credit infrastructure also complement fintech growth. For example, ASEAN governments are improving credit bureau coverage and encouraging alternative credit scoring using utility or e-commerce data, which helps fintech lenders assess thin-file SMEs. Some countries (like Thailand and Indonesia) have special credit guarantee corporations that co-guarantee SME loans – fintech lenders can potentially tap these schemes to reduce risk and extend more credit. Regulators are also urging banks to simplify collateral requirements and develop tailored SME loan products with flexible terms. The overarching regulatory trend is a recognition that SME finance needs a multi-pronged approach – fintech innovation, bank partnership, public-sector support – to truly solve the financing gap. By coordinating efforts and aligning incentives, ASEAN policymakers aim to build a more inclusive financial ecosystem where even the smallest businesses can access the funding and tools they need.

Vemanti Group: Capitalizing on the FinTech-SME Trend in ASEAN

Vemanti Group, is strategically positioned to ride this wave of SME-focused fintech innovation across Southeast Asia – starting with Vietnam as its initial “hilltop.” Vemanti’s mission is to advance financial inclusion for unbanked and underbanked businesses by building a comprehensive digital financial ecosystem.

1. Pioneering a Digital SME Banking Platform in Vietnam: Vemanti’s flagship initiative is to launch one of Vietnam’s first SME-centric digital banks through a partnership with PVcomBank. This 10-year collaboration, officially inked in 2022, marries PVcomBank’s full banking license and local market presence with Vemanti’s fintech expertise. PVcomBank, a state-owned commercial bank with 108 branches, provides a solid foundation and was even recognized as “Best Digital Bank in Vietnam” in 2021. On top of this, Vemanti is layering modern technologies – cloud computing, API integrations, automated KYC/AML, artificial intelligence, machine learning, and blockchain – to power a digital-first banking platform. The result will be a Vemanti-branded neobank where Vietnamese SMEs can open accounts, make payments, and apply for financing entirely online via web or mobile. For entrepreneurs used to lengthy paperwork and branch visits, this is a game-changer. Yet, uniquely, if they do need in-person support, they can walk into a PVcomBank branch, thanks to the partnership’s “phygital” hybrid model. This combination of a seamless digital experience with optional human touch aims to build trust among SME owners who may be transitioning from cash-based, informal finance to digital banking for the first time. By leveraging PVcomBank’s core systems and compliance framework, Vemanti can focus on user experience and innovation without starting from scratch on licensing – a smart market entry strategy that avoids the pitfalls many standalone fintechs face.

2. Tailored Financial Products for Underserved SMEs: Understanding that SME needs differ from large corporates, Vemanti plans to offer a suite of custom financial products beyond generic loans. Importantly, Vemanti has also engaged Lendscape, a specialist in invoice and supply-chain finance technology, to enable offerings like invoice financing and short-term working capital loans. These are exactly the types of financing that many SMEs need – for example, a 3-month loan to buy raw materials for a big order, or unlocking cash stuck in unpaid invoices – but which banks rarely provide due to rigid policies. By using Lendscape’s solution, Vemanti can assess credit based on an SME’s receivables and business performance, not just fixed assets. This data-driven credit decisioning will allow more entrepreneurs to qualify for funding, and do so faster. As Vemanti’s CEO, Tan Tran, noted, SMEs in the region often “struggle to meet collateral requirements designed for large corporations, leaving many unable to access formal financial services”. Vemanti’s platform intends to fill this void by offering personalized financing that fits SMEs’ cash flow cycles, whether it’s a micro-loan to a mom-and-pop shop or supply chain finance for a growing manufacturer. All of it will be delivered via an app or online portal that is accessible 24/7, cutting out layers of bureaucracy. This focus on being “tech-driven but human-led” – using advanced fintech tools while keeping customer needs at the center – is core to Vemanti’s strategy. It not only helps SMEs thrive, but also aligns with Vietnam’s national digital transformation goals and the push for financial inclusion.

3. Bridging Traditional Banking and Digital Assets: Vemanti isn’t stopping at conventional banking services. A distinguishing aspect of its strategy is the integration of cryptocurrency and blockchain-based solutions into its ecosystem – effectively bridging the gap between traditional banking and the digital asset world. In 2023–2025, Vemanti made bold moves in this direction by investing in and now moving to acquire 100% of ONUS Pro, a leading Southeast Asian cryptocurrency exchange platform. ONUS Pro (operated by Onus Finance UAB) is a well-established exchange with millions of users in the region, offering trading in 600+ digital assets and a secure crypto wallet service. By bringing ONUS Pro fully under the corporate umbrella, Vemanti is positioning itself at the forefront of fintech convergence. The company envisions a future where an SME customer on its platform might handle routine banking and also access digital asset services seamlessly – for instance, converting a portion of receivables into a USD-backed stablecoin for easy cross-border transfers, or using blockchain for secure record-keeping. Vemanti has already entered strategic discussions with xBank, a next-generation digital banking platform, to explore integrating traditional banking services with blockchain-powered digital assets. The goal is to deliver “seamless, compliant, and accessible” financial solutions that cater to both fiat and crypto needs of SMEs and retail clients.

A concrete example is Vemanti’s work on a USD-pegged stablecoin called USDV, intended as a cross-border payment tool. Recognizing the importance of regulatory clarity, Vemanti is evaluating pathways under the newly introduced U.S. GENIUS Act to ensure USDV is compliant and scalable. If successful, this could allow Vietnamese and ASEAN SMEs to easily transact with global partners in a stable digital currency, speeding up remittances and reducing costs compared to traditional forex channels. As Tan Tran puts it, “the future of finance lies in convergence”, and by aligning with innovative regulations and partnering with forward-thinking entities like xBank, Vemanti aims to sit “at the intersection of innovation and regulatory clarity”. This forward-looking approach could differentiate Vemanti from other fintech startups – few are incorporating a crypto exchange, a stablecoin, and a digital bank under one roof to serve SMEs.

4. Partnerships and Regional Expansion: Vemanti’s strategy heavily emphasizes partnerships, which not only accelerate development but also de-risk its expansion across ASEAN. Beyond PVcomBank, Finastra, Lendscape, ONUS, and xBank, Vemanti will likely continue to seek alliances in other target markets. Its vision is to help businesses become “borderless” across Southeast Asia, meaning a Vietnamese SME client should eventually be able to do business in, say, Thailand or Indonesia via Vemanti’s platform with minimal friction. As Vemanti scales, it could partner with local banks or fintechs in different countries to replicate the Vietnam model – providing the technology and platform know-how, while the local partner provides licenses and market access. The company’s public listing on the OTC market also gives it access to capital for growth and lends credibility when negotiating with established institutions. Already, the market has responded positively to Vemanti’s moves: upon news of the ONUS Pro acquisition plan, Vemanti raised its 2025 revenue forecast above $30 million, citing ONUS Pro’s strong growth and the expanding pipeline of fintech services. This momentum, combined with Vemanti’s clear focus on the booming SME segment, has positioned it as an emerging player to watch in ASEAN’s fintech landscape.

Disclaimer

This article may contain forward-looking statements, which are subject to risks and uncertainties. Actual results may differ materially, and Vemanti Group, Inc. (“Vemanti”) undertakes no obligation to update such statements except as required by law. The content is provided for informational purposes only and does not constitute investment, legal, tax, or accounting advice, nor an offer or solicitation to buy or sell any security, product, or service. Descriptions of products, services, or features are general in nature, may be restricted or unavailable in certain jurisdictions, and are subject to change without notice. Data, statistics, and third-party information are provided “as is,” may contain errors or inaccuracies, and should not be relied upon without independent verification. The Company disclaims any liability for reliance on this content. All trademarks and brands are the property of their respective owners.

Sources:

FinTech for SMEs: How Digital Platforms Are Bridging the Gap in ASEAN

SMEs comprise over 90% of all businesses in the region and contribute heavily to GDP and jobs. In Vietnam alone, SMEs and private business households produce roughly half of GDP and 82% of employment. Despite their importance, most SMEs struggle to access affordable credit. Traditional banks often consider small firms high-risk due to insufficient collateral, limited financial records, or informal operations. As a result, an estimated 98% of Vietnamese SMEs have difficulty securing bank loans or face exorbitant interest rates. The situation is similar across emerging ASEAN markets – roughly 39 million SMEs (51% of the total in Southeast Asia) are unserved or underserved by financing, contributing to a massive $272 billion SME funding gap in Southeast Asia. These businesses typically need smaller, short-term loans and quick credit decisions, which traditional lenders are ill-equipped to provide. The financing shortfall has real economic costs, constraining business expansion and innovation.

Digital Platforms Bridging the Gap for Small Businesses

Across ASEAN, a wave of digital platforms – from lending fintechs to neobanks and crypto services – are bridging the gap for underserved SMEs. These platforms bring alternative financing, easier banking, and new financial tools directly to small businesses:

- Peer-to-Peer and Alternative Lending: Online lending marketplaces have scaled up to connect SMEs with capital outside traditional banks. In Indonesia, for instance, P2P lender Akseleran has disbursed nearly IDR 6.6 trillion (over $400 million) in loans to small businesses by 2022. Such platforms allow groups of investors or institutions to fund SME loans at competitive rates, often using flexible terms and innovative credit scoring. Malaysia’s CapBay platform similarly uses data analytics to provide supply chain financing and has facilitated over MYR 3 billion (~$640M USD) to more than 1,700 underserved SMEs. By leveraging machine learning and alternative data, these fintech lenders can offer smaller, short-term loans and invoice financing that banks have historically avoided. The result is faster access to working capital for inventory, cash flow, or expansion needs – without the onerous collateral requirements of banks.

- Neobanks and Digital Banking Services: A new breed of digital-only banks is emerging to serve entrepreneurs and small enterprises with convenient, low-cost banking. In Singapore, regulators awarded digital banking licenses aimed at enhancing inclusion – Ant Group’s ANEXT Bank launched in 2022 as a wholesale digital bank focusing on micro and SMEs, offering quick online business accounts and lending solutions. Regional fintech startups like Aspire have built all-in-one finance platforms for SMEs, providing everything from multi-currency business accounts to expense management and payable/receivable tools. Headquartered in Singapore, Aspire now helps over 15,000 companies across Asia manage payments and cash flow digitally, and saw its annualized transaction volumes triple to $12 billion in 2023. These digital-native services save SMEs time and money, with features like instant account opening, integration with accounting software, and data-driven credit lines without heavy paperwork. The ASEAN region is also seeing incumbents partner with fintechs – for example, Thailand’s KBank and Indonesia’s BTPN have launched app-based SME banking services – blurring the line between traditional and challenger banks in the SME segment.

- Embedded Finance in Platforms: Some of the biggest impacts have come from fintech embedded in e-commerce, payments, and super-app ecosystems that SMEs already use. Southeast Asia’s super-apps (like Grab and GoTo) and online marketplaces now provide financial services to the small businesses on their platforms. Grab Financial Group’s “Grow with Grab” initiative is one example – Grab offers working capital loans and micro-insurance to its network of drivers, delivery partners, and merchant sellers seamlessly through its app. In fact, Grab’s data-driven micro-lending products for small businesses and gig workers have addressed a critical gap in the credit market, disbursing $420 million in loans in just Q2 2025 and maintaining a low 1.8% non-performing loan ratio. By analyzing ride-hailing and sales data, Grab can extend credit to entrepreneurs who banks would deem “un-creditworthy,” all within a user-friendly mobile interface. Similarly, e-commerce platforms are enabling sellers to get financing based on their online sales history, and fintech partners like Funding Societies (Modalku) have teamed up with marketplaces to lend to merchants. This embedded finance approach folds banking into the software SMEs use daily, making access to capital almost invisible and exceedingly convenient.

- Digital Payments and Cross-Border Tools: Fintech innovation has also made it easier for small businesses to pay and transact globally – a domain once dominated by banks. Cross-border payment fintechs such as Airwallex and Wise provide SME-friendly platforms to send and receive international payments with lower fees and better FX rates, helping businesses integrate into global supply chains. Meanwhile, digital wallets and QR payments have proliferated in domestic markets (e.g. Vietnam’s MoMo, Malaysia’s Boost), enabling even micro-entrepreneurs and street vendors to accept cashless payments and build a transaction history. This digital footprint can later support credit assessments. Cryptocurrency platforms and blockchain innovations are starting to play a role as well. For instance, some SMEs are beginning to use stablecoins (crypto tokens pegged to fiat currency) to handle cross-border remittances and supplier payments, avoiding high bank transfer costs. Regulators in ASEAN are cautiously opening doors to such innovation – in 2025, the Vietnamese government introduced its first licensing regime for cryptocurrency exchanges, launching a five-year pilot to integrate digital asset trading into the formal financial system. By recognizing and regulating digital assets, Vietnam aims to enable blockchain-powered financial services under proper oversight, which could eventually benefit SMEs through new funding and payment options. Fintech companies that bridge traditional finance and crypto – offering, say, invoice loans alongside stablecoin remittance services – may give SMEs a more borderless financial toolkit.

ASEAN Case Studies: Fintech Impact on SMEs

The fintech-for-SME trend is evident in success stories across Southeast Asia’s diverse markets. A few examples illustrate how digital platforms are empowering small businesses in the region:

- Indonesia: Home to a booming fintech lending industry, Indonesia has leveraged regulation (through the Financial Services Authority, OJK) to foster responsible P2P lending growth. Platforms like Akseleran connect thousands of Indonesian SMEs with retail and institutional lenders, providing flexible loan terms and even accepting non-traditional collateral. By 2022 Akseleran had served more than 200,000 individual lenders and disbursed over IDR 6.6 trillion (about $407 million) in loans, an 80% revenue increase from the prior year. Other Indonesian fintech leaders include KoinWorks and Modalku (Funding Societies), which together have funneled billions of rupiah into the small business sector that banks historically ignored. The government reports that fintech lenders have reached many first-time SME borrowers, though ensuring prudent risk management remains a priority. The Indonesian case shows how a large financing gap can be narrowed when tech and regulatory support align.

- Malaysia: In Malaysia, fintech innovation in supply chain and invoice financing is helping SMEs maintain cash flow. CapBay, an award-winning Malaysian fintech, partners with banks and uses a proprietary credit-decisioning model to evaluate SMEs based on trade data and relationships, not just balance sheets. This approach has enabled CapBay to channel over MYR 3 billion (≈$643 million) to more than 1,700 SMEs across 20 industries, even offering micro-sized financing deals as low as MYR 100 (≈$21) to include the smallest enterprises. By tapping analytics and machine learning to assess risk, CapBay and peers have expanded financing to businesses that would otherwise be too costly for banks to underwrite. Malaysia has also embraced digital banking – in 2022, Bank Negara Malaysia awarded several digital bank licenses aimed at underserved segments, prompting traditional banks to up their digital game for SME customers.

- Singapore: As a regional fintech hub, Singapore has encouraged both incumbents and startups to deliver SME-centric financial services. Aspire (Singapore) exemplifies the new generation of SME neobanks. Founded in 2018, Aspire offers a one-stop financial platform with business accounts, corporate cards, expense tracking, and automated invoice management, all through a single app. Its user base has spread beyond Singapore to other ASEAN markets, and by 2023 Aspire was handling $12 billion in annualized payment volumes for its clients while attracting major investors like Sequoia and Y-Combinator. At the same time, Singapore’s traditional banks are innovating: DBS, for example, launched a quick online SME account opening service and AI-driven lending. The Monetary Authority of Singapore’s introduction of digital bank licenses pushed big tech players into the fray as well – ANEXT Bank (by Ant Group) and Green Link Digital Bank both debuted in 2022 to serve SMEs and cross-border commerce, leveraging their parent companies’ fintech expertise. These developments underscore a broader trend: banks and fintechs in Singapore are collaborating and competing to make SME banking more accessible, digital, and data-driven, from instant loan approvals to integrated accounting solutions.

- Vietnam: Vietnam represents a significant “hilltop” opportunity for fintech to transform SME finance, given its fast-growing economy and large population of underserved businesses. The country has around 800,000 enterprises and 5 million sole proprietorships fueling its economy, yet conventional bank lending reaches only a sliver of them. Nearly 70–80% of Vietnamese SMEs cannot access bank loans due to lack of collateral or credit history. In practice, many resort to informal “black credit” sources at high interest, or limit their growth ambitions. Recognizing this, Vietnam’s government and central bank (SBV) have prioritized digital banking and fintech solutions as key to improving SME access to finance. Vietnam is also witnessing rapid adoption of e-wallets (e.g. MoMo, ZaloPay) among merchants and consumers, creating a more digital-friendly financial ecosystem. With supportive moves like the government’s sandbox for crypto exchanges and efforts to bolster credit guarantee funds, Vietnam is laying groundwork for fintech to flourish. The stage is set for innovative platforms to fill the massive credit gap and help Vietnamese SMEs – who currently contribute ~41% of GDP – reach their full potential.

- Regional Super-App Finance: Large tech platforms across ASEAN have turbocharged financial inclusion for micro-entrepreneurs. We’ve touched on Grab’s fintech expansion; similarly, Indonesia’s GoTo Group (formed from Gojek and Tokopedia) provides fintech services to drivers and small retailers, and Philippines’ Mynt (GCash) offers mobile credit to small shop owners based on wallet transactions. Even as standalone fintechs thrive, these ecosystem approaches show how integrating finance into everyday digital services can rapidly scale outreach. The common thread is data – by leveraging transaction data, ride logs, or sales history, these platforms can underwrite credit and insurance for users who lack traditional financial records. And thanks to their consumer reach, they can educate and upsell users on financial products in a familiar context. This has been critical in ASEAN markets where trust in banks is low but smartphone use is high. Regulators have largely welcomed these developments, issuing digital bank licenses to consortia involving tech firms (as seen in Malaysia, Indonesia, Singapore) and updating fintech regulations to ensure consumer protection while encouraging innovation.

Regulatory Trends Supporting FinTech Innovation

One reason fintech platforms are booming in ASEAN is a gradually more supportive regulatory environment. Policymakers have recognized that traditional financial rules need updates to accommodate new digital models that benefit SMEs. Key regulatory insights and trends include:

- Digital Banking Frameworks: Several ASEAN countries have created new licensing categories for digital banks, many with a mandate to promote financial inclusion. Singapore led the way by granting digital full bank and wholesale bank licenses in 2020; winners like Grab-Singtel (GXS Bank) and Ant Group (ANEXT) explicitly focus on underserved consumers and small businesses. Malaysia followed in 2022, awarding five digital bank licenses aimed at innovative models to reach the unbanked and micro-SMEs. These frameworks typically require robust capitalization and compliance, but allow non-bank players to offer banking services without a brick-and-mortar presence. Indonesia updated its rules to accommodate digital banking by both incumbents and new entrants (for example, Bank Jago’s digital transformation). And while Vietnam has not issued a separate digital bank license yet, it enabled partnerships like PVcomBank–Vemanti to operate under existing bank charters, effectively achieving digital bank functionality. Regulators are striking a balance between innovation and stability – ensuring new digital banks have proper risk controls while pushing incumbent banks to digitize and SME-proof their offerings.

- Fintech Sandboxes and Pilots: To safely experiment with new financial technologies, regulators across ASEAN have introduced sandboxes and pilot programs. For instance, Bank Indonesia and the OJK have sandbox programs for P2P lending, digital payments, and most recently fintech credit scoring, which helped craft regulations that legitimize P2P lending as a significant industry. Thailand and Philippines have similar sandboxes allowing fintechs to test products under supervision before mass rollout. A notable development is Vietnam’s aforementioned crypto asset pilot program – in 2025 the government launched a 5-year sandbox for regulated digital asset exchanges. Under Resolution No. 05/2025/NQ-CP, Vietnam will license a limited number of crypto exchange operators who meet strict capital and compliance requirements, bringing what was a grey-market activity into an official framework. This not only protects investors but also paves the way for innovations like stablecoins for cross-border payments, which could greatly benefit SMEs engaged in international trade. The sandbox approach in ASEAN has proven useful in gathering data and adjusting policies – as seen with Malaysia’s early P2P/EDI (equity crowdfunding) sandbox leading to formal guidelines that now oversee dozens of alternative finance platforms.

- Open Banking and Data-Sharing Regulations: Some ASEAN regulators are implementing or exploring open banking rules, which require banks to share customer data securely with third-party fintech apps (with consent). Singapore’s API Exchange (APIX) and Malaysia’s Open Data initiatives are steps in this direction. By liberating customer financial data (transaction history, etc.), open banking can enable fintech lenders to better evaluate SME borrowers and offer customized products. It also spurs the development of fintech solutions that aggregate accounts, help with cash flow forecasting, etc., giving SMEs a more holistic financial view. While still in nascent stages in ASEAN compared to Europe’s PSD2 regime, the momentum is growing. Indonesia’s regulators have signaled moves toward open finance frameworks, and Vietnam has mentioned digital banking as part of its Strategy for Banking Digital Transformation by 2025. As these policies mature, they will further level the playing field for fintechs and encourage banks to partner via APIs, ultimately benefiting SMEs with more choice and competition.

- Credit Infrastructure and Guarantees: Government initiatives to bolster credit infrastructure also complement fintech growth. For example, ASEAN governments are improving credit bureau coverage and encouraging alternative credit scoring using utility or e-commerce data, which helps fintech lenders assess thin-file SMEs. Some countries (like Thailand and Indonesia) have special credit guarantee corporations that co-guarantee SME loans – fintech lenders can potentially tap these schemes to reduce risk and extend more credit. Regulators are also urging banks to simplify collateral requirements and develop tailored SME loan products with flexible terms. The overarching regulatory trend is a recognition that SME finance needs a multi-pronged approach – fintech innovation, bank partnership, public-sector support – to truly solve the financing gap. By coordinating efforts and aligning incentives, ASEAN policymakers aim to build a more inclusive financial ecosystem where even the smallest businesses can access the funding and tools they need.

Vemanti Group: Capitalizing on the FinTech-SME Trend in ASEAN

Vemanti Group, is strategically positioned to ride this wave of SME-focused fintech innovation across Southeast Asia – starting with Vietnam as its initial “hilltop.” Vemanti’s mission is to advance financial inclusion for unbanked and underbanked businesses by building a comprehensive digital financial ecosystem.

1. Pioneering a Digital SME Banking Platform in Vietnam: Vemanti’s flagship initiative is to launch one of Vietnam’s first SME-centric digital banks through a partnership with PVcomBank. This 10-year collaboration, officially inked in 2022, marries PVcomBank’s full banking license and local market presence with Vemanti’s fintech expertise. PVcomBank, a state-owned commercial bank with 108 branches, provides a solid foundation and was even recognized as “Best Digital Bank in Vietnam” in 2021. On top of this, Vemanti is layering modern technologies – cloud computing, API integrations, automated KYC/AML, artificial intelligence, machine learning, and blockchain – to power a digital-first banking platform. The result will be a Vemanti-branded neobank where Vietnamese SMEs can open accounts, make payments, and apply for financing entirely online via web or mobile. For entrepreneurs used to lengthy paperwork and branch visits, this is a game-changer. Yet, uniquely, if they do need in-person support, they can walk into a PVcomBank branch, thanks to the partnership’s “phygital” hybrid model. This combination of a seamless digital experience with optional human touch aims to build trust among SME owners who may be transitioning from cash-based, informal finance to digital banking for the first time. By leveraging PVcomBank’s core systems and compliance framework, Vemanti can focus on user experience and innovation without starting from scratch on licensing – a smart market entry strategy that avoids the pitfalls many standalone fintechs face.

2. Tailored Financial Products for Underserved SMEs: Understanding that SME needs differ from large corporates, Vemanti plans to offer a suite of custom financial products beyond generic loans. Importantly, Vemanti has also engaged Lendscape, a specialist in invoice and supply-chain finance technology, to enable offerings like invoice financing and short-term working capital loans. These are exactly the types of financing that many SMEs need – for example, a 3-month loan to buy raw materials for a big order, or unlocking cash stuck in unpaid invoices – but which banks rarely provide due to rigid policies. By using Lendscape’s solution, Vemanti can assess credit based on an SME’s receivables and business performance, not just fixed assets. This data-driven credit decisioning will allow more entrepreneurs to qualify for funding, and do so faster. As Vemanti’s CEO, Tan Tran, noted, SMEs in the region often “struggle to meet collateral requirements designed for large corporations, leaving many unable to access formal financial services”. Vemanti’s platform intends to fill this void by offering personalized financing that fits SMEs’ cash flow cycles, whether it’s a micro-loan to a mom-and-pop shop or supply chain finance for a growing manufacturer. All of it will be delivered via an app or online portal that is accessible 24/7, cutting out layers of bureaucracy. This focus on being “tech-driven but human-led” – using advanced fintech tools while keeping customer needs at the center – is core to Vemanti’s strategy. It not only helps SMEs thrive, but also aligns with Vietnam’s national digital transformation goals and the push for financial inclusion.

3. Bridging Traditional Banking and Digital Assets: Vemanti isn’t stopping at conventional banking services. A distinguishing aspect of its strategy is the integration of cryptocurrency and blockchain-based solutions into its ecosystem – effectively bridging the gap between traditional banking and the digital asset world. In 2023–2025, Vemanti made bold moves in this direction by investing in and now moving to acquire 100% of ONUS Pro, a leading Southeast Asian cryptocurrency exchange platform. ONUS Pro (operated by Onus Finance UAB) is a well-established exchange with millions of users in the region, offering trading in 600+ digital assets and a secure crypto wallet service. By bringing ONUS Pro fully under the corporate umbrella, Vemanti is positioning itself at the forefront of fintech convergence. The company envisions a future where an SME customer on its platform might handle routine banking and also access digital asset services seamlessly – for instance, converting a portion of receivables into a USD-backed stablecoin for easy cross-border transfers, or using blockchain for secure record-keeping. Vemanti has already entered strategic discussions with xBank, a next-generation digital banking platform, to explore integrating traditional banking services with blockchain-powered digital assets. The goal is to deliver “seamless, compliant, and accessible” financial solutions that cater to both fiat and crypto needs of SMEs and retail clients.

A concrete example is Vemanti’s work on a USD-pegged stablecoin called USDV, intended as a cross-border payment tool. Recognizing the importance of regulatory clarity, Vemanti is evaluating pathways under the newly introduced U.S. GENIUS Act to ensure USDV is compliant and scalable. If successful, this could allow Vietnamese and ASEAN SMEs to easily transact with global partners in a stable digital currency, speeding up remittances and reducing costs compared to traditional forex channels. As Tan Tran puts it, “the future of finance lies in convergence”, and by aligning with innovative regulations and partnering with forward-thinking entities like xBank, Vemanti aims to sit “at the intersection of innovation and regulatory clarity”. This forward-looking approach could differentiate Vemanti from other fintech startups – few are incorporating a crypto exchange, a stablecoin, and a digital bank under one roof to serve SMEs.

4. Partnerships and Regional Expansion: Vemanti’s strategy heavily emphasizes partnerships, which not only accelerate development but also de-risk its expansion across ASEAN. Beyond PVcomBank, Finastra, Lendscape, ONUS, and xBank, Vemanti will likely continue to seek alliances in other target markets. Its vision is to help businesses become “borderless” across Southeast Asia, meaning a Vietnamese SME client should eventually be able to do business in, say, Thailand or Indonesia via Vemanti’s platform with minimal friction. As Vemanti scales, it could partner with local banks or fintechs in different countries to replicate the Vietnam model – providing the technology and platform know-how, while the local partner provides licenses and market access. The company’s public listing on the OTC market also gives it access to capital for growth and lends credibility when negotiating with established institutions. Already, the market has responded positively to Vemanti’s moves: upon news of the ONUS Pro acquisition plan, Vemanti raised its 2025 revenue forecast above $30 million, citing ONUS Pro’s strong growth and the expanding pipeline of fintech services. This momentum, combined with Vemanti’s clear focus on the booming SME segment, has positioned it as an emerging player to watch in ASEAN’s fintech landscape.

Disclaimer

This article may contain forward-looking statements, which are subject to risks and uncertainties. Actual results may differ materially, and Vemanti Group, Inc. (“Vemanti”) undertakes no obligation to update such statements except as required by law. The content is provided for informational purposes only and does not constitute investment, legal, tax, or accounting advice, nor an offer or solicitation to buy or sell any security, product, or service. Descriptions of products, services, or features are general in nature, may be restricted or unavailable in certain jurisdictions, and are subject to change without notice. Data, statistics, and third-party information are provided “as is,” may contain errors or inaccuracies, and should not be relied upon without independent verification. The Company disclaims any liability for reliance on this content. All trademarks and brands are the property of their respective owners.

Sources:

weforum.org vietnamlawmagazine.vn vietnamnet.vn fintechnews.sg vietnam-briefing.com assets.ctfassets.net vietnam-briefing.com crowdfundinsider.com grab.com fintechfutures.com vemanti.com vietnam-briefing.com fintechfutures.com nasdaq.com stocktitan.net

thank you